Thinking of purchasing property in Australia? This is an overview of the changes to the property market since the pandemic. Finally, we will look to what the future looks like for the Australian property market.

How did the pandemic impact the Australian property market?

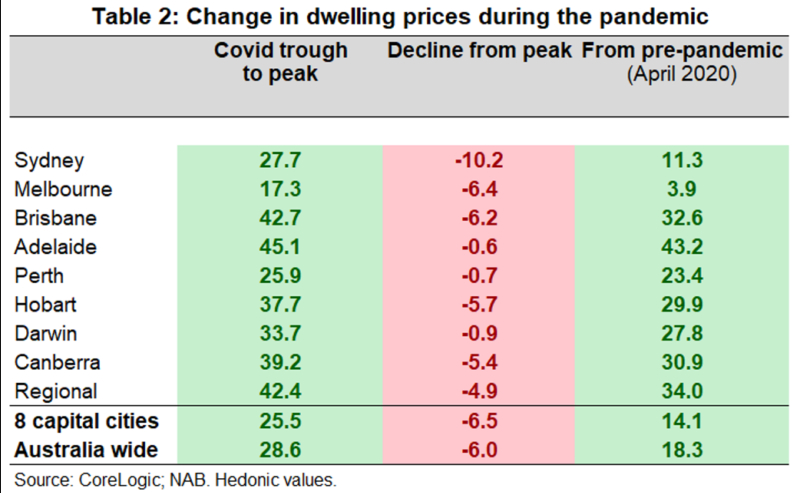

During the coronavirus pandemic, for the most part, property prices across Australia boomed. This occurred for several reasons: the Australian government cut interest rates to historic lows and the economy was pumped with new stimulus, which saw savings grow. Additionally, the new impetus to work-from-home saw many people relocating for a new way of life, as well as a new-found preference for detached homes over units. Furthermore, there was an increase in first-time homebuyers.

There were, however, differences across the country.

Melbourne’s house prices rose significantly less than Sydney’s during 2020-21. Six lockdowns, intermittent bans on in-person inspections, and border closures left the Victorian property market in a state of confusion at times. In the financial year 2020-21, Melbourne’s population fell by 60,500 people. International students left and Melbournians escaped the city and the lockdowns. Over the same period, only 5,150 people left Sydney.

What happened to the Australian property market in 2022?

2022 has seen property prices across Australia drop. As it follows, those areas that saw the highest growth during pandemic have also seen the greatest drops.

The Sydney property market has seen a -10.2 decline from its peak. Meanwhile, Melbourne’s is – 6.4.

Indeed, some Sydney suburbs have seen property prices fall back down to pre-pandemic levels. The largest drop has been felt by units rather than houses.

These changes have been caused by the Reserve Bank of Australia tightening interest rates after putting them at a low to help the urgent economic problems that the pandemic threatened to create.

What will happen to the Australian property market?

Sweeping ups and drastic downs – it can all feel hard to keep track of.

If you are a Brit wanting to purchase a property in Australia, then it might all feel a little overwhelming.

Analysts are not seeing the fall in property prices as a crash, rather, they are framing it as a correction. Michael Yardney, a leading property commenter in Australia, of Michael Yardney Property Update writes, ‘it’s an orderly correction which had to occur after house prices got ahead of themselves.’

Very recently, there was some growth in the property market.

In September, the asking price for established houses listed in Sydney had a 0.5% recorded fall. But by October, this had steadied.

In October, other locations saw increases in median house prices. Adelaide was up 3%, Perth 0.9%, and Melbourne 0.4%.

For the most part, analysts are reluctant to make predictions. When pressed, some experts predict growth and others foresee further falls. Michael Yardney predicts that prices will continue to fall, although he acknowledges the reasons others may disagree with him.

However, there is a universal agreement that the Australian property market will stabilise in 2023. Whether up or down, it will be by much smaller increments than that which have characterised the last couple of years. The Australian economy is healthy, unemployment is down, but with interest rates no longer so low, it will be harder to save for a deposit – these factors will contribute to that stabilisation.

The takeaway

The Australian property market is not a monolith. Michael Yardney stresses that different areas will be at different stages of the property cycle. This is evident with the example of Sydney having such a boom in the pandemic to go on to have falls this year, while Melbourne experienced a comparatively smaller boom and fall. Therefore, if you are looking to purchase property in Australia, you should keep a tabs on the specific area you are looking at buying in, be it inner city Melbourne or rural New South Wales.

If you were put off purchasing property in Australia because of the intense changes over the last few years, thankfully, it looks as if the market will steady. So, prospective buyers will be able to make a purchase with more knowledge, certainty and confidence in the market they are buying into.

Would you like more advice on moving to Australia? Our Australia buying guide might be for you.