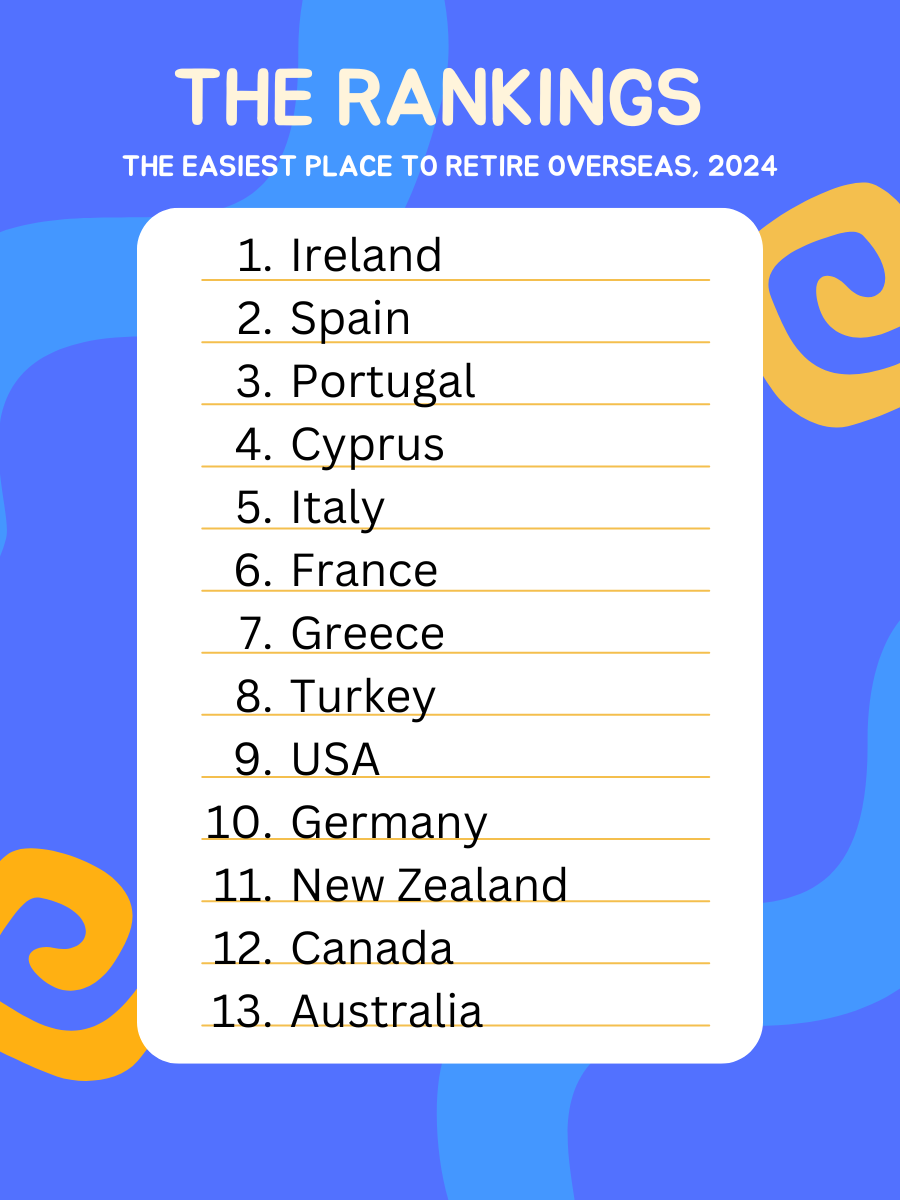

The Easiest Place to Retire Overseas, 2024

Brought to you by Property GuidesRetirement, some say, is when you stop living at work and start working at living.

For many of us, that means retiring overseas to enjoy the sun, a new environment and a fresh, new lease of life.

But while many retirees are healthy, wealthy and raring to go, most countries require a visa. These can be hard to get. Indeed, some of our favourite countries make it almost impossible.

The easiest place to retire overseas for UK citizens

That’s why, for The Easiest Place to Retire Overseas, 2024, we ranked the countries in terms of how easy they are to retire to.

That includes how easy it is to get a visa for those aged 60+, and the cost and range of visas.

We also measured those things that make a country easy for British retirees to settle into, such as English being spoken (although we always advise trying to learn the language) and how sunny the country is, given that this is proven to improve mental and physical health.

And we measured those factors that make it easier to live there as a retiree, including the cost of living, quality of healthcare and how safe you will feel.

Importantly, when you retire overseas will your British pension be uprated there each year in line with the UK’s pensions triple lock?

Christopher Nye, senior editor at Property Guides says:

“Retiring overseas is not just a wonderful adventure, there are also good practical reasons. From lower living costs for those on a pension, to warmer winters that encourage us to be healthier and more active.

Living new experiences, in a new place, can stop time rushing past so fast, while learning a language and culture will keep a brain active. Meeting new people and making friends can rejuvenate our lives too.

But retiring abroad is a legal and financial process, especially for British people since the UK left the European Union. There are several indexes for ‘best’ places to retire abroad, but we think it would just be frustrating to discover that the best place to retire is also near impossible to retire to!

That’s why the Your Overseas Home Easiest Places to Retire Overseas rankings are based purely on the practicalities.

The most interesting result was that years after Brexit rules came in, countries like France, Spain, Portugal and Cyprus are still rolling out the red carpet to retirees from the UK, at least compared to countries like the USA and New Zealand.

“This is wonderful news for those who have long dreamt of a move to the sun and a whole new lease of life. While there is a legal and financial barrier to retiring abroad, for anyone of good character, reasonable health and able to support themselves economically, the world remains their oyster.”

Is there a retirement visa?

Given the assets that many baby boomer retirees often have, having benefitted from the rise in their property values, it’s surprising how few countries welcome them officially with a retirement visa. Australia, for example, makes it very hard to move there over the age of 55.

All countries want to be sure that older people moving there can look after their health and finances. Visas aimed at retirees can go by other names, including Spain with its “non-lucrative visa” and Portugal’s DB-7 visa. These are visas that require you to demonstrate a passive income – i.e. an income from pensions, investments, or rental income, that doesn’t require you to work. There is generally no lower or upper age limit for such visas, which you will find in France, Italy, Cyprus and Greece, as well as Spain and Portugal.

So, almost top marks for those countries, which are mainly in Europe, although New Zealand does have a retirement-type visa. Ireland takes the top spot, though, as no visa is required at all for British people.

“Retiring overseas is not just a wonderful adventure. There are also good practical reasons to take this exciting step, from lower living costs for those on a pension, to warmer winters that encourage us to be healthier and more active.”

Christopher Nye

Minimum passive income required

The various passive income visas all have different minimum income requirements. As these are usually related to the national minimum wage, they change each year.

Spain’s is one of the most expensive. At 400% of Spain’s minimum wage, it is currently around €27,000 (£23,000) per year for the first applicant. Just over the border in Portugal, it is less than €8,500 per year. Turkey’s is the cheapest, working out at a little over £5,000, while Italy requires over €30,000.

For each, there is a smaller amount extra for a couple or other dependents.

Availability and cost of a golden visa

These are residence or citizenship by investment visas, commonly known as the “golden visa”. Most countries want wealthy people to invest in their country. That led many of them, including the UK, to offer visas in return for large investments. Some countries sought to boost luxury property sales by including residential property as an investment option.

Most countries are now cancelling their residential investment option, including Cyprus and Portugal, and Spain will soon be closing its own. However, for now, you can still get one in Spain, Greece and Turkey, for as little as a €250,000 property, and these we have judged the easiest to retire to.

For more information on the visas available in each country, browse our buying guides on the Property Guides homepage.

Do they speak English there?

While retirement abroad will always be easier if you can speak the local language, that’s not possible for everyone.

English-speaking countries like Ireland, the USA, Canada and New Zealand of course score highly here. After that, we based the score on the number of British expats in the country, meaning that Spain scored well, while Turkey, for example, slipped down the rankings.

Cost of living

When you are living on a fixed income such as a pension – and especially if you’re not allowed to work because of your visa – it will make your retirement much easier if you are sure you can make ends meet.

Our rankings are based on the Property Guides Cost of Living Overseas Index, which calculates a wide variety of costs typically associated with setting up a home abroad. That includes not just groceries and eating out, but also furniture, technology, healthcare including a visit to the dentist, maintaining your property and getting a cleaner in for a couple of hours each week.

Turkey made up some ground here, while New Zealand is looking less desirable for anyone hoping to live somewhere where their pension goes further.

Bear in mind that we chose a representative shopping basket, but yours may be different and there are always bargains to be found.

Feeling safe

It’s vital, especially as one gets older, to feel confident and safe in one’s neighbourhood. It’s not just about avoiding becoming a victim of crime; it’s also about not feeling that you’re likely to be preyed on.

For this factor, we used the “Better Life Index” compiled by the Organisation for Economic Cooperation and Development (OECD). They asked people in their 34 member nations some qualitative questions (“Do you feel safe walking home at night?”) and put them alongside actual crime rates.

All of our countries scored considerably better than some OECD nations, such as Mexico and Colombia, but generally, the European nations scored best. Among the countries compared in our retire overseas survey, Portugal was the winner and Turkey was last. However, other studies have found that overall, crime is actually very low in Turkey, with total crimes reported 23 times less than in the UK.

Happiness Index

Retiring to a place where people report themselves to feel happy is a good indicator of how you will feel there too. While happiness is subjective and not necessarily influenced by how others feel, external factors can have a powerful influence.

The Nordic countries always score well for happiness, but of the countries in our analysis, it was Commonwealth countries Australia, New Zealand and Canada that did best. The Eastern Mediterranean came out less well, with Turkey, Greece and Cyprus propping up the table.

Please bear in mind, that this is a poll of the general population. It is NOT specifically a poll of the retired and expatriates and their experience may be very different.

Healthcare Index

There is no getting away from the fact that bodies start to break down more in older age, no matter how hard we work at exercising and eating well. So, the quality of local healthcare can be a major factor for us all, especially those with a precondition such as diabetes or hypertension.

Many visas require you to take out health insurance, often offering better access than local state services. However, those moving for the long term may require state services when they gain long-term residency.

We have taken our rankings from a Legatum Prosperity Index. Top scorers were Germany, Italy and France, in that order. Bottom of the pile was the USA.

State pension uprated

This was a binary choice for British retirees. In those countries which are uprated, the old age pension from the UK increases each year in line with the ‘triple lock’. This means the highest of either inflation, average earnings or 2.5%. In 2024, UK pensioners got an extra 8.4%, and that was extended to retirees in all our countries except Canada, New Zealand and Australia.

People in those countries remained on the state pension they had when they left the UK.

Sunshine hours

Does sunshine make it easier to retire overseas? While happiness data appears to favour cooler, greyer, northern nations, historically not many of us have chosen to move to Sweden rather than Spain.

For those with more time on their hands, once they have retired, we believe that more sunshine will help retirees settle in more easily and enjoy their time.

Sunshine varies across the country so we have taken the most popular areas for retirees within that country. The southern Mediterranean scored well, with Cyprus in top place, followed by Portugal and then the USA (based on Florida being a top retirement choice).

Ireland came last with the lowest hours of sunshine, followed by France and Germany following on. However, those who want the sun in France of course have the choice of Nice rather than Normandy.

“If you’re looking to retire overseas to a luxury property, the golden visa can be an appealing option. It offers residency via your investment in real estate. I think we would call that a win-win situation! Even in countries where the property element has gone, you can still usually invest in companies or government bonds.”

Roseanne Bradley

“When you are choosing where to move in a different country it can be difficult to immediately spot the areas best avoided. You should usually just trust your feelings, but I’ve found that searching local websites reveals interesting information too. If posts are mainly along the lines of, ‘Who has lost these keys?‘ you are onto a winner.”

Julia Silk

Browse our selection of free guides

1 | Country | 'Retirement' visa? Y1/N10 | Income requirement: | Cost of investor visa: | English spoken: | Cost of living | Safety (OECD) | Happiness index | Healthcare index | Pension uprated | Sunshine hours ranking | Total | Final rankings |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2 | Spain | 1 | 7 | 4 | 7 | 2 | 2 | 8 | 7 | 1 | 5 | 44 | 2 |

3 | France | 1 | 5 | 5 | 9 | 11 | 6 | 7 | 3 | 1 | 11 | 59 | 6 |

4 | Portugal | 1 | 3 | 7 | 8 | 4 | 1 | 11 | 10 | 1 | 2 | 48 | 3 |

5 | Italy | 1 | 8 | 7 | 12 | 3 | 7 | 9 | 2 | 1 | 8 | 58 | 5 |

6 | Cyprus | 1 | 4 | 5 | 6 | 9 | 7 | 10 | 8 | 1 | 1 | 52 | 4 |

7 | Greece | 1 | 6 | 2 | 10 | 5 | 8 | 12 | 11 | 1 | 6 | 62 | 7 |

8 | Ireland | 0 | 1 | 1 | 1 | 7 | 3 | 4 | 5 | 1 | 13 | 36 | 1 |

9 | USA | 10 | 10 | 10 | 1 | 10 | 9 | 5 | 13 | 1 | 3 | 72 | 9 |

10 | Canada | 10 | 10 | 9 | 1 | 8 | 5 | 3 | 9 | 11 | 11 | 77 | 12 |

11 | Germany | 10 | 10 | 12 | 11 | 6 | 4 | 6 | 1 | 1 | 12 | 73 | 10 |

12 | Turkey | 1 | 2 | 3 | 13 | 1 | 12 | 13 | 12 | 1 | 5 | 63 | 8 |

13 | New Zealand | 1 | 9 | 11 | 1 | 13 | 11 | 2 | 6 | 11 | 10 | 75 | 11 |

14 | Australia | 10 | 10 | 12 | 1 | 12 | 10 | 1 | 4 | 11 | 7 | 78 | 13 |