With interest rates still climbing and the post-Covid rush well behind us, what’s happening in the French property market this summer? The good news is you’ll be paying no more than in the spring, but don’t expect too much of a bargain.

After a reasonable start to the year, predictions from many estate agents and notaries for the French property market are finally starting to come true, with demand starting to even out and price rises moderating, following record sales figures post Covid.

Find homes in France via our property portal.

Prices

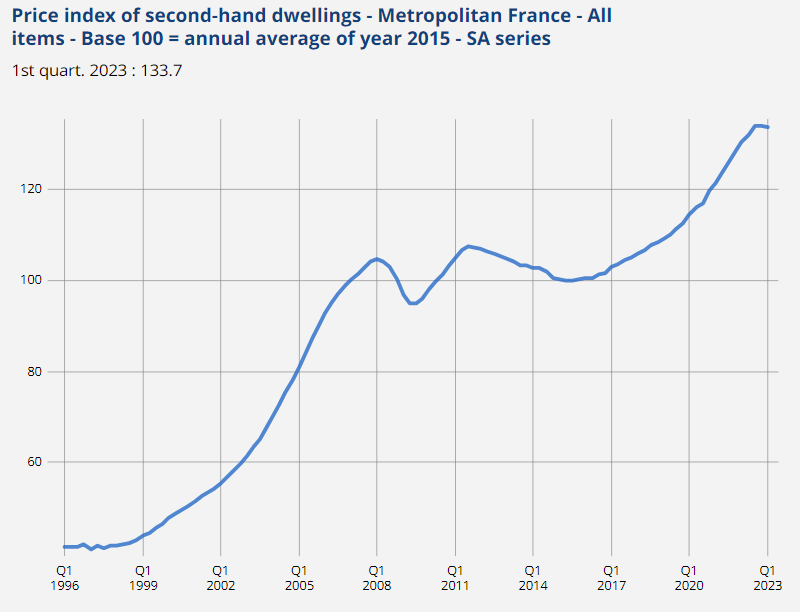

The French National Real Estate Federation predicted as much as a 10% drop in square metre prices in 2023. This has emphatically not happened. Prices are stabilising rather than dropping. According to official statistocs from INSEE, prices for second hand dwellings in metropolitan France peaked in the last quarter of 2022 and have barely moved since.

Stabilised, but no big fall

Interestingly, for areas that experienced price increases at the end of 2022, including Bordeaux, Nantes, Lyon and Paris, prices are now starting to fall. However as yet not dramatically. In general, the evolution of most prices over the past few years whilst having dropped, have not yet reached deficit. Overall things seem to be simply rebalancing and the French Property Market is not yet experiencing any massive downturn.

We don’t see the kind of up to date information on prices as in the UK and US, but house price data from the European Union suggests that French prices up to the end of 2022 were doing better than in most of Europe. There was a small drop, if at all, compared to hefty drops for property prices in Germany and Cyprus and a small drop in Spain.

So any idea that an outrageous offer will be accepted by desperate vendors can be forgotten. The bigger issue is more likely to be shortage of supply. Estate agents are suggesting that people who have no urgent need to buy or sell, are waiting it out to see how the economic uncertainty caused by the cost of living crisis develops. Transaction volumes fell from a high of 1,200,000 per annum last August to 1,083,000 in February. However, this is still the same level as immediately pre-pandemic and some well above 2016-2018 levels.

What does this actually mean for buyers?

For the expat buyer looking to relocate permanently and enjoy life here, this can only be good news. Cash buyers in particular should be making ready to buy a bargain.

For those looking to move here permanently, additionally the abolishment of the taxe habitation for primary residences is a real bonus. The French government rolled this out this in a bid to encourage primary residence sales over second homes (primarily aimed at the domestic French market). They have also started to enforce energy efficient renovation stipulations for rentals which many French landlords will not consider, either due to financial reasons or because it is too bothersome. Therefore, perhaps some of the previous competition will have dropped off when searching for your dream home.

Properties hit by renovation costs

Earlier this year, it was reported by Notaires, that demand and prices for older homes were dropping. In fact, Fédération Nationale de l’immobilier (FNAIM) has reported that this is affecting property types across the French property market this summer. An external factor perhaps affecting the types of property that people are looking to buy is the rising cost of labour and materials for renovation projects.

There have also been constraints placed on some areas of new construction by the current drought in France. Some communes have now put a complete hold on construction permits.

Holiday home buyers

Of course Brexit has played a part in a small reduction of UK expats now buying in France, although not as much as perhaps expected. The French still remain the largest number of people buying second homes in France at approximately 40%, with Brits following on not that far behind. They are estimated to make up 28% of the second home-buyers market, with Americans, Belgian and German buyers far behind them at around only 6%.

Although, it is true that the percentage of people not permanently resident in France buying second homes here has dropped over the last 10 years. However, with mortgages becoming harder to attain and interest rates rising due to the world-wide economic crisis, this is to be very much expected.

Property Guides

Property Guides France

France Portugal

Portugal Spain

Spain Italy

Italy USA

USA Ireland

Ireland Greece

Greece Cyprus

Cyprus Australia

Australia New Zealand

New Zealand Canada

Canada Turkey

Turkey UK

UK