Now is the time to live abroad and purchase an investment property in the UK; especially if you are living in a country with a strong currency.

With the decline of the pound and uncertainty surrounding Brexit, British expats are finding another way for property ownership to work for them while living abroad. According to offshore mortgage provider Skipton International, there has been a surge in mortgage enquiries from British expats wishing to purchase buy-to-let properties inside the UK. This makes perfect sense. Expats who are making good money in countries such as Hong Kong, Singapore or Switzerland have greater purchasing power and are able to take advantage of the weaker pound and the declining property prices in parts of the UK.

There has been a surge in mortgage enquiries from British expats wishing to purchase buy-to-let properties inside the UK.

The first half of 2017 saw a surge in enquiries from British expats wishing to buy-to-let in the UK. In Asia there has been a 141% increase from the same period last year, with a 162% increase from UK expats in Hong Kong and a 115% increase from Singapore. These Asian currencies, which are more impacted by the US dollar than the pound or euro, have seen significant gains compared to the pound since the EU referendum last year.

The Vauxhall Tower, in London’s up-and-coming south bank

European-based British expats are also becoming more interested in buying in the UK while remaining abroad. Mortgage enquiries from British expats living throughout the European Economic Area have increased 117%, while other parts of Europe have doubled. Switzerland has seen the biggest spike in enquiries at 118% for the first half of 2017, showing the strength of the Swiss Franc over the pound in recent months.

To make the best decisions on UK investment, download our UK Buying Guide, produced in association with Rightmove.

Despite the increase in stamp duty for second home owners and the decrease in mortgage tax relief, UK property as an investment opportunity has been an attractive prospect for some time now. It isn’t just about the investment, UK citizens living abroad are seeing the advantage of securing a property to live in if they decide to move back home or purchasing a place for their children.

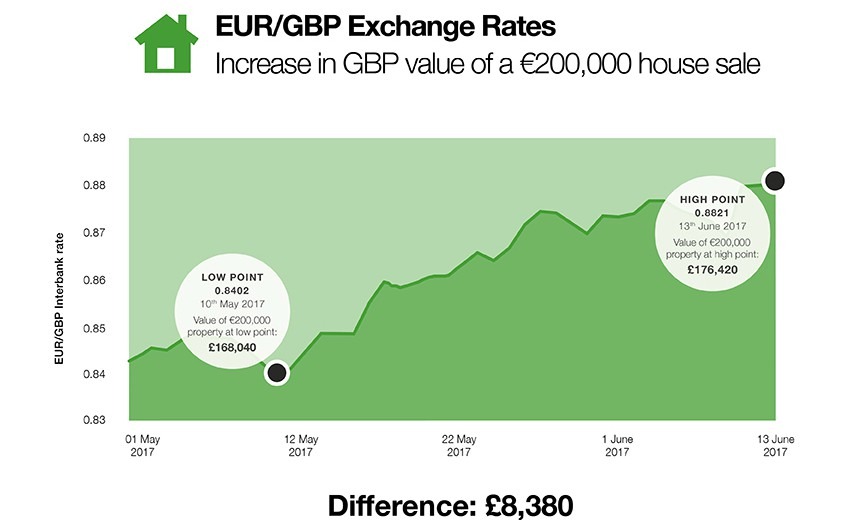

See the attached currency chart from Smart Currency Exchange to see how much extra has been added to your sterling budget with the fall in the pound just in the past month

For those looking to move abroad and purchase property, and especially for those moving to destinations with strong currencies compared to the British pound, a buy-to-let arrangement is the perfect way to capitalize on a buyer’s market here in Britain and keeping a toe in the UK market.